InvestorBill

It explains how cryptocurrency works, how you can make money from it and gives essential tips on how you can start investing today!

About Us

InvestorBill is the go-to resource for beginner investors. We provide tips and guides to help you get started in the world of investing, and make the most of your money. Whether you’re looking to buy your first stock, or just want to learn more about the market, InvestorBill has you covered.

Our Mission

Our mission is to help everyone become financially independent and secure their future. With InvestorBill, there’s no need to be intimidated by investment jargon – we’ll break it all down for you in easy-to-understand language. So come on over and join the community of beginner investors!

Grow with Us

Learning for Earning

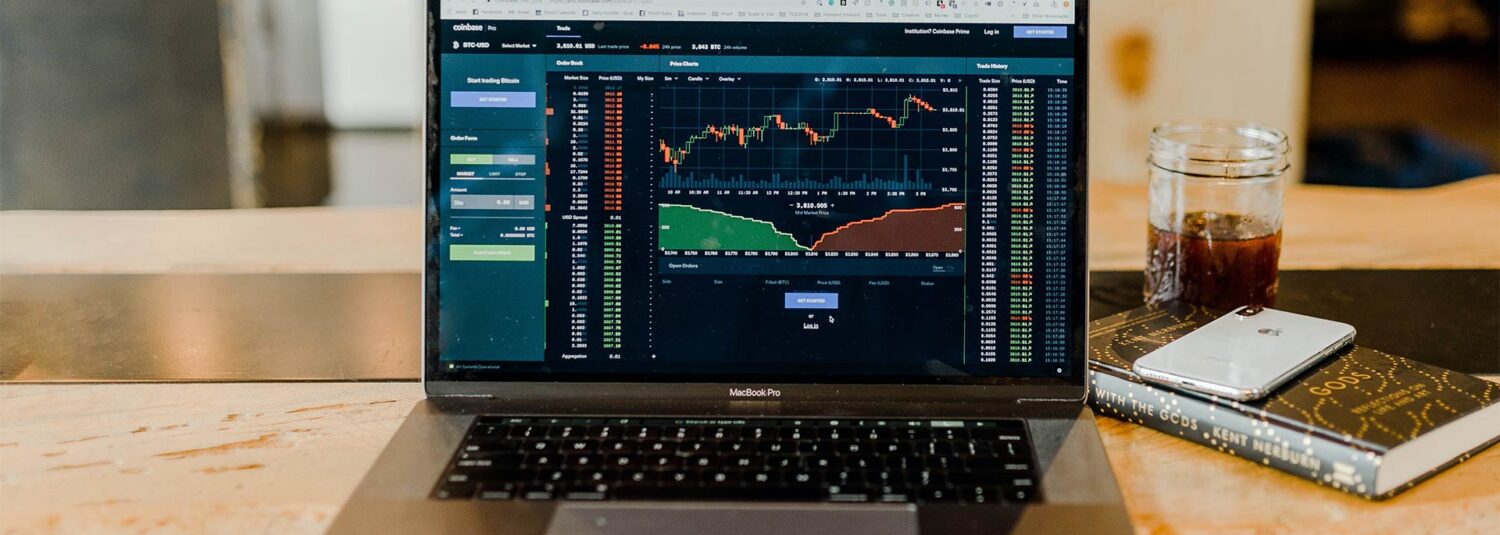

One of the primary motivations behind creating InvestorBill: A Beginner’s Guide to the Basics of Investing and Business was to eradicate the long-standing “rich get richer, poor get poorer” trend. The second rationale was to provide regular people a way to profit from their familiarity with well-known companies.

Here to Help

Our goal in bringing all of our content to the web is to make it easier for our readers to make educated decisions and feel secure in their ability to handle all of their personal finance needs.

Enjoy Your Money

Many folks aren’t happy with their financial situation. Boring employment and mounting debt prevent them from moving on in life. Finding your strengths and making a living doing what you love are two of the most important steps toward a happy and fulfilling life, and this website may help you do both.