InvestorBill

It explains how cryptocurrency works, how you can make money from it and gives essential tips on how you can start investing today!

Author: Dan Haro

Crypto ETFs, or exchange-traded funds, have become increasingly popular in recent years as a way for investors to gain exposure to the cryptocurrency market. These ETFs are investment vehicles that track the price of cryptocurrencies such as Bitcoin or Ethereum, and allow investors to invest in the cryptocurrency market...

Read More

Roblox’s popularity skyrocketed during the pandemic, leading to a highly anticipated and successful IPO in March. Before investing, let’s explore this online gaming phenomenon that has resonated with young people around the world. Dive into Roblox’s books for more information about its exciting market entry! What is Roblox? Roblox...

Read More

Many people believe that college is the only option after high school, but there are other professional options out there. Don’t let your blinded ambition for success stop you from considering all available routes. College vs. Trade School: Admissions Process and Requirements The first difference you’ll notice between college and...

Read More

Many investors believe that municipal bonds are a great way to diversify. However, it’s important to know the pros and cons before adding them to your portfolio. In this post, we will share 10 advantages and disadvantages of municipal bonds so you can decide if they’re right for you!...

Read More

With Bitcoin being one of the most popular cryptocurrencies in circulation, it’s no surprise that mining for this currency is both difficult and volatile. But if you own bitcoins (and want to make money off your investment) there may be a need to convert them into real-world currencies like...

Read More

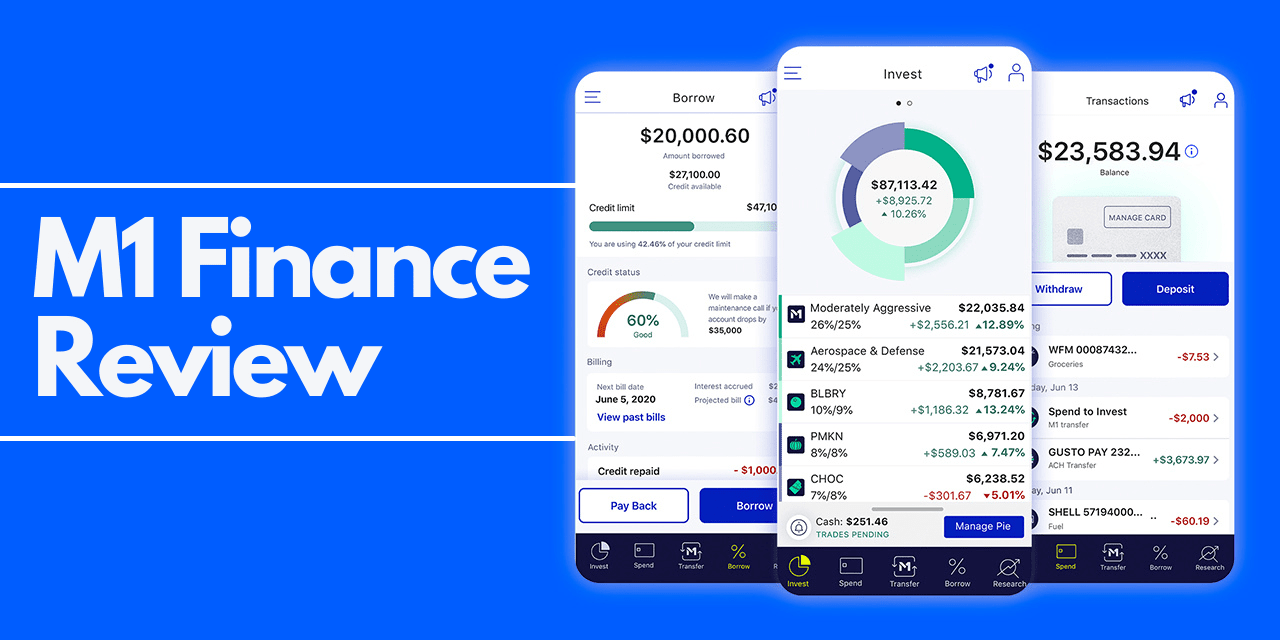

Who is M1 Finance? M1 Finance is an investing platform that allows you to invest for free. That’s right, there are no commission fees or account minimums. You can invest in stocks, ETFs, and even some cryptocurrencies. What makes M1 Finance different from other investment platforms is its unique...

Read More

In this post, we will analyze the primary advantages and disadvantages of Flexible Spending Accounts (FSAs) to help you determine if signing up for one is the best decision for you. 5 Pros Of Flexible Spending Accounts You Can Save On Taxes The money you contribute to your FSA...

Read More

There’s no need to pay extra for rental insurance when your personal coverage or credit card likely already offers the same benefits. At the rental car company, you will probably be asked if you want to buy their insurance. The attendant may rattle off a list of things that...

Read More

Although it may seem risky, there are many benefits to allowing someone else to manage your finances. For example, This way of handling money could help you curb impulsive spending and better learn how to be responsible with your funds. Why hire someone to pay your bills? There are...

Read More

A loan that doesn’t require collateral is called an unsecured loan. Lenders usually decide if you’re eligible for this type of financing by looking at your credit score and financial history. With an unsecured loan, you have more freedom in how you spend the money. However, be sure to...

Read More